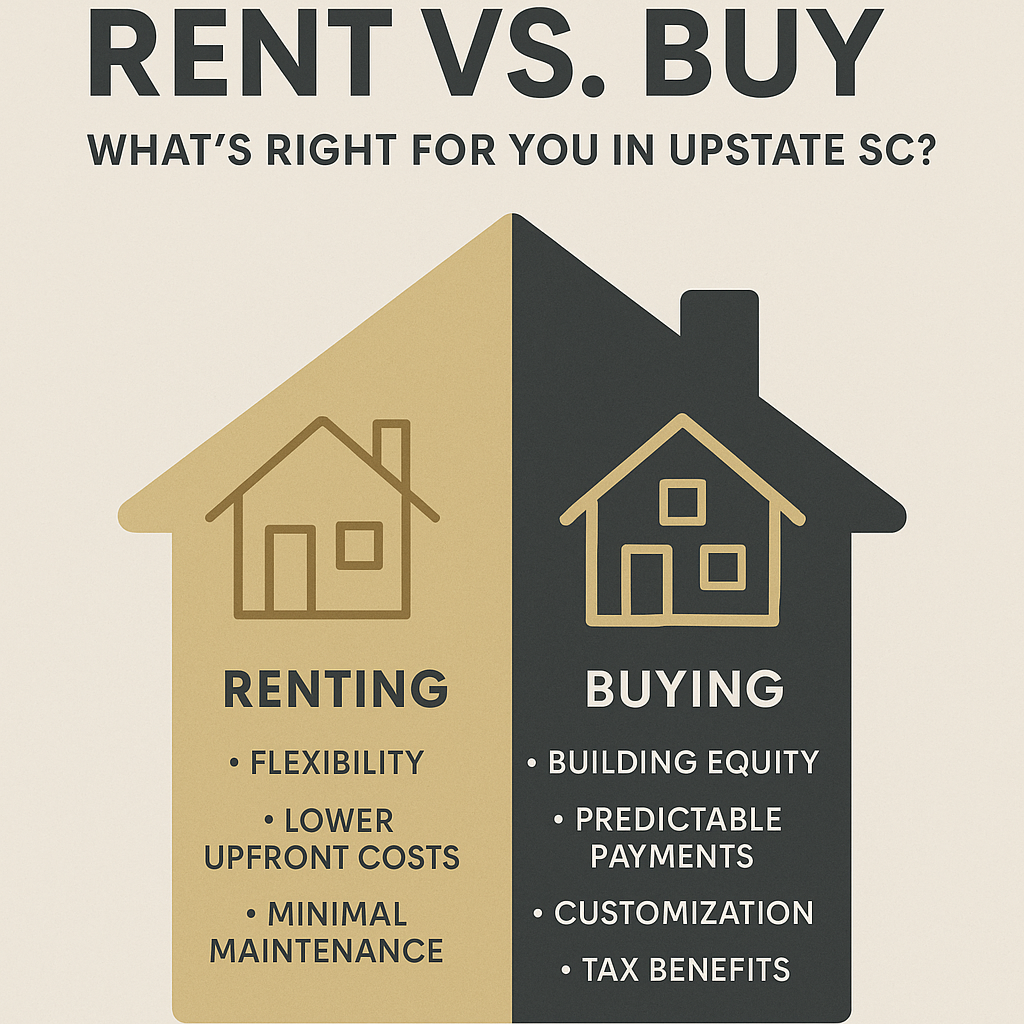

Rent vs. Buy: What’s Right for You in Upstate SC?

Rent vs. Buy: What’s Right for You in Upstate SC?

Deciding whether to rent or buy a home is one of the biggest financial choices you’ll make—and in a dynamic market like Upstate South Carolina, the answer isn’t always simple. With interest rates, home prices, and rental demand constantly shifting, it’s important to weigh both the numbers and your lifestyle goals.

Let’s break down the key considerations to help you decide what’s best for you.

Current Market Snapshot in Upstate SC

-

Home Prices: The Upstate continues to see moderate growth, especially in sought-after areas like Greenville, Spartanburg, and Anderson. While prices have risen over the past few years, they remain more affordable than major metro areas in the Southeast.

-

Interest Rates: Mortgage rates have fluctuated, but many buyers are locking in stable long-term rates that beat rising rent costs.

-

Rental Market: Rents in Upstate SC have climbed steadily, particularly in urban areas and near major employers. Many tenants are finding that monthly rent now rivals or even exceeds a mortgage payment for a similarly sized home.

Pros of Renting

-

Flexibility: Renting gives you the ability to move easily, which is ideal for those uncertain about long-term plans.

-

Lower Upfront Costs: Renters typically pay only a security deposit and application fees—no down payment or closing costs required.

-

Minimal Maintenance: Repairs and upkeep are usually handled by the landlord.

Best for:

-

Short-term residents

-

People exploring new job opportunities

-

Those saving for a larger down payment

Pros of Buying

-

Building Equity: Every mortgage payment you make builds equity—and ownership can help grow long-term wealth.

-

Predictable Payments: With a fixed-rate mortgage, your housing costs stay stable compared to rising rents.

-

Customization: You can paint, remodel, and truly make the space your own.

-

Tax Benefits: Mortgage interest and property taxes may be tax-deductible, adding long-term savings.

Best for:

-

Long-term Upstate SC residents

-

Growing families

-

Those seeking stable monthly payments and equity growth

Cost Comparison: Rent vs. Buy Example

Let’s say you’re choosing between renting a 3-bedroom home in Greenville for $1,800/month or purchasing a similar home for $275,000.

Buying (with 5% down):

-

Mortgage + taxes/insurance: ~$1,950/month

-

Equity built over time

-

Fixed payment, potential appreciation

Renting:

-

$1,800/month

-

No equity

-

Rent likely to increase annually

While buying may cost slightly more up front, you're investing in your future and stabilizing your living costs.

Final Thoughts

There's no one-size-fits-all answer—but understanding your finances, goals, and timeline will guide the right choice. In Upstate South Carolina, the decision to buy is looking more appealing for many residents, especially those who plan to stay and grow roots.

Still unsure? I’d be happy to run a personalized rent vs. buy comparison based on your goals and local options. Let’s find the right path for you.

Recent Posts